That stakeholder workshop you’re planning or that expensive Qualtrics setup you bought isn’t going to lead to exceptional business outcomes alone.

Mizaru, Kikazaru and Iwazaru are the three wise monkeys or “mystic apes” from Japanese Buddhist lore, commonly known from the maxim “See no evil, hear no evil, say no evil.” Although multiple interpretations of it exist, it’s often used to refer to those who refuse to acknowledge impropriety, feign ignorance or just look the other way.

So why am I referencing our famous simian friends? Simply put, organizations that rush ahead with the design and build of a product or service with faux personas (faux-sonas?), customer journeys based almost entirely on stakeholder hearsay from a workshop or two, and backlogs based on light competitive takeaways are quite literally, monkeying around. This UX theater as it’s been described not only cheats the customers of the organization but also cheats the organization’s bottom line; not to mention it wastes the time and patience of expensive talent on the program trying to deliver excellence.

Perhaps an even more unfortunate organization is one that budgets almost exclusively on evaluative research through the fetishization of metrics like the Net Promoter Score. Why? Because focusing on NPS has come to sound smart through its Hahvahd origins and it’s relatively easy to implement despite questionable tactics and outcomes.

To be clear, evaluative research methods and the insights they offer can indeed serve great value, but if there was ever the possible pitfall of “painting the pig”, it’s relying almost solely on evaluative research to inform your product/service roadmap. And if you think an Apple or an IDEO got to where they are by focusing on evaluative research, I have a bridge to sell you.

So, what is generative customer research you ask?

If you don’t know, I’m not telling you yet because suspense is fun. Let’s first cite a few business statistics that generative research is a powerhouse in delivering;

“Customer-centric companies are 60% more profitable than companies that don’t focus on customers.”

-Forbes

“Strategic client experience design has the potential to raise usage and conversion rates by as much as 400%”

-Forrester Research

“Fixing a problem in development costs 10 times as much as fixing it in design and 100 times as much if you’re trying to fix the problem in a product that’s already been released”

-Forbes

Generative customer research is simply a suite of methods that generate insights through direct involvement with or observation of target users/customers. Although all methods are primarily qualitative in nature, nearly all can capture some quantitative insight through tallying similar responses. You’re not going to get to a level of statistical significance but it isn’t as important when the goal of most research is practical business significance in the first place.

Example generative customer research methods include things like user interviews, direct observation, ethnographic research and a favorite of mine, Participatory Design. The primary focus of all of these methods is to discover the true problem/opportunity space which acts as a foundation to realize those positive statistics cited.

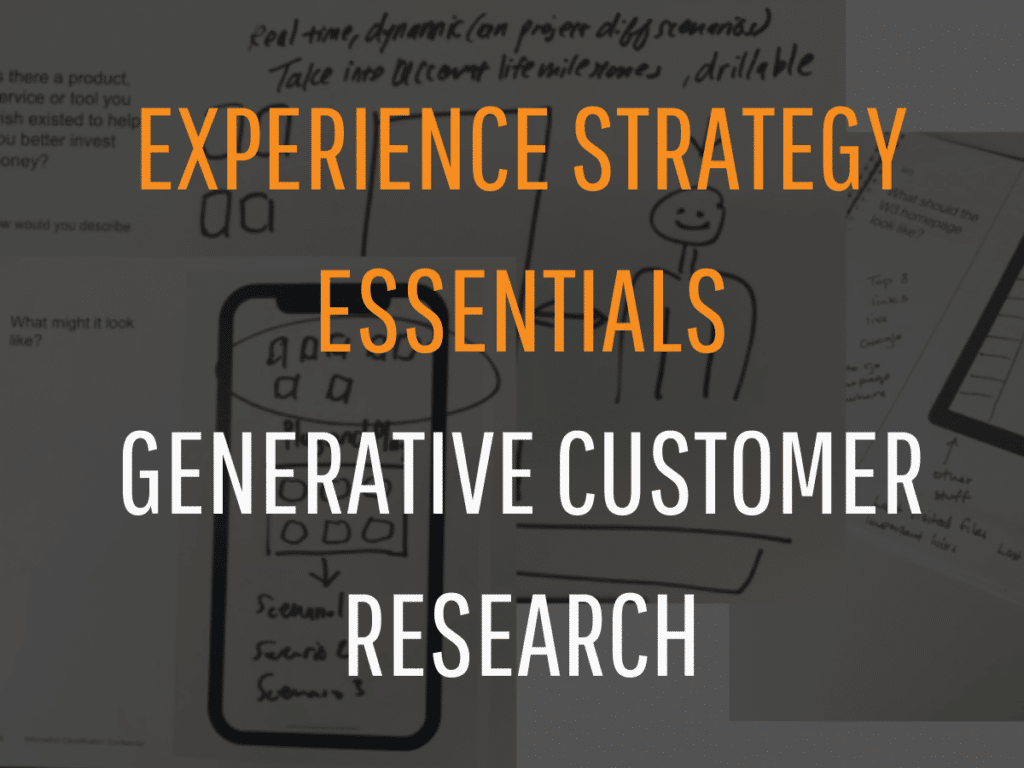

Generative customer research method example – Participatory Design

Participatory Design provides a direct window into the pains, needs and hopes of target customers/users of a product or service by giving them the power of visualization. This research method features a structured workbook featuring various custom exercises that’s moderated by the researcher. The approach is to first ask participants how they might describe a particular pain point, need or want and then follow up with the question “how might it look like” using a visual trigger such as a blank smartphone screen to aid their doodling. It’s remarkable how far even non-design pros get in sharing pain points or compelling ideas through doodles. Although no expert team would address all findings without seeing clear patterns first, nothing gets stakeholders excited as much as being able to literally see potentially major insights from customers. I’ve had the opportunity to deploy this method across several products and services, notably at BNY Mellon bank for a retail wealth management platform exploration and for IBM’s global intranet redesign to dramatically enhance the product roadmap.

Define the outcomes you need

Determine the three biggest unmet customer needs? Absolutely. Provide stakeholders with key themes to further creative solutioning? No problem. The point is, your organization can define a generative research program with clear outcomes regarding major customer experience blind spots and transformative business opportunities. Some final points to consider;

- Discovery or a sprint zero phase should nearly always include generative research if you want to get to true customer-centric realizations to fuel innovation and the bottom line.

- High-performing organizations understand that design and development are never “done” but should forever be improved upon. Kill off the fallacy in your organization that direct user research must be done before the kickoff of the design and development phases. If your organization is truly or even attempting to be agile and iterative, new major insights from ongoing generative research can be incorporated into the roadmap for concepting and effort/value prioritization.

That’s generative customer research and its value proposition in a nutshell. If any of this sounds remotely eye-opening, please reach out to us at the Collective and we’ll work with you to define a custom generative customer research program to drive more successful outcomes for your product or service.